Are You Prepared to Take Control of Your Future?

Learn Minor Things That No Body’s Gonna Tell You.

Learn Minor Things That No Body’s Gonna Tell You.

It seems that everyone is a little confused about swing trading. People are unaware of how quickly or slowly the process moves. In this blog post, I’ll clarify this in between explanations of swing trading.

Let’s examine the basic meaning of swing, which is: to move or induce to move on an axis or when suspended, back and forth or side to side.

Moving back and forth is now the same when it comes to trading.

However, how can you spot this move on a trading chart?

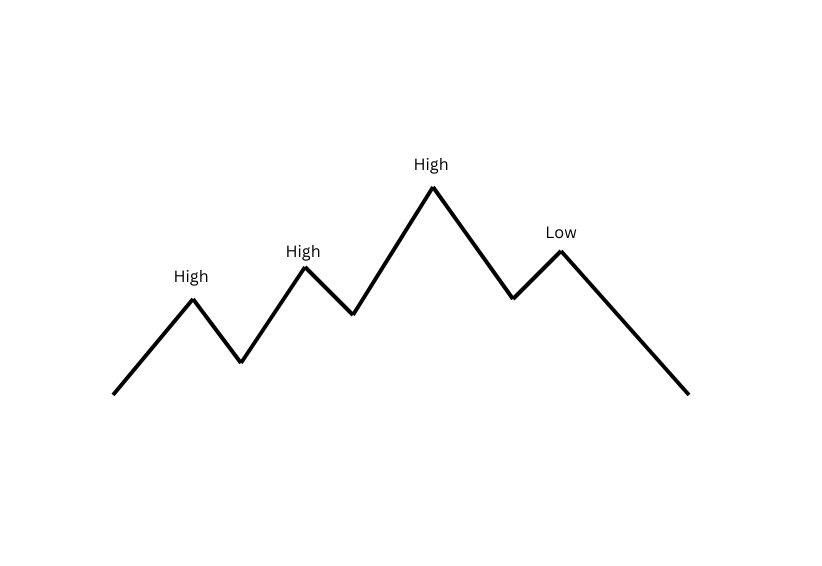

These highs and lows are displayed on this trading graph. We call them swings.

Finding those swing highs and lows and establishing a trading position is the skill of swing trading. Finding a general trend and making more money within it is the aim.

Let’s distinguish between several forms of trade.

| Scalping/Gambling | Lasts from seconds to minutes |

| Day trading/Intraday | Day only |

| Swing trading | Lasts from Days to weeks |

| Positional/Long-term trading | Lasts from months to weeks |

The question that now arises is why one ought to pick swing trading and what assets to select.

Swing trading is superior to other types of trading in this regard. Swing trading is the perfect option for those who lack patience and want to make money quickly.

It’s not an intraday trade, it’s not gambling, and it’s not a long-term investment. Which implies you can make a sizable profit in a brief amount of time. Lastly, and perhaps most importantly, swing trading allows you to trade a variety of equities, which will help you see a variety of patterns and broaden your understanding of the market. Additionally, having this expertise will help you become a day trader.

How can Swings be recognized?

Finding these swings is not a particularly difficult process. There are swings in this visual representation, which show the highs and lows. The graphic above illustrates how simple it is to identify these fluctuations.

You can detect swings by monitoring your highs and lows, supports, and resistance. Additionally, technical analysis can provide you with a clearer understanding of the swings.

We will utilize trending indicators to find these swing lows because our goal is to play the swings in a rising market. Moving averages are among the easiest technical indicators to utilize.

Additionally, you may use:

However, if you use more indicators, your trading signals might reduce. This is why we try to limit the number of technical indicators to use for swing trading.

Swing trading has the advantage of allowing you to select assets from:

For a swing trader to generate significant profits, focus is necessary. The portfolio’s results will resemble the market to a greater extent as you hold more assets.

These holdings all show various approaches to portfolio diversification. Specific risk, or the risk associated with a particular position, is decreased by holding multiple positions. Furthermore, diversity makes your portfolio resilient to market fluctuations because the profits from certain investments might balance the declines from other ones.

Conclusion:

Both beginner and expert traders employ swing trading tactics. Fundamental reasoning is comparatively easier to comprehend and apply.

Swing trading methods, however, are not risk-free like other trading strategies, therefore you must exercise caution when selecting technical indicators and when determining the parameters for entering and leaving trades.

Leave a comment