Are You Prepared to Take Control of Your Future?

Learn Minor Things That No Body’s Gonna Tell You.

Learn Minor Things That No Body’s Gonna Tell You.

Making money daily sounds so good and exciting but we have yet to learn how much hard it is and risky at the same time.

When I was learning about the stock market this term INTRADAY TRADING was something that clicked in my mind and when I read about it, it turned out to be the most challenging thing ever, also you’ll always learn something new from the market.

Here’s a short story

Somebody warned me not to jump into F&O (future and options) before trading equity. So what I did, was I traded equity-like one or two times and then jumped into F&O. Also the return in F&O is finer than equity. So when I started trading the very first day I invested around 10K which is the minimum amount to invest in F&O. Luckily I closed my trade-in profit. I thought I was ready to become a full-time trader because I made good profits today.

And then the second day I invested the same amount again but no profits this time. And this moment I realized how many blunders I made.

Let’s discuss what I realized after making tons of mistakes:

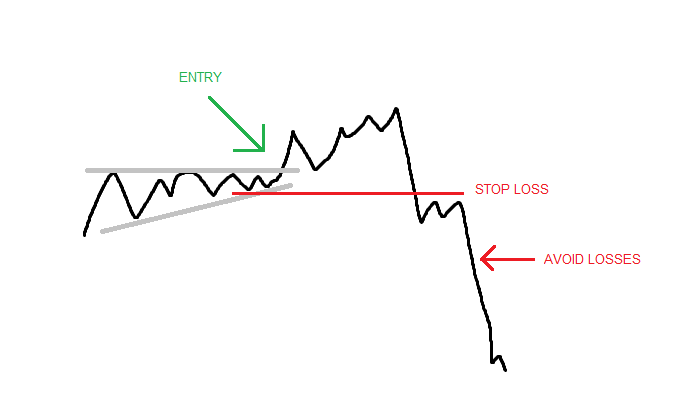

1- Stop- loss:

Stop loss is a must while you’re trading specially intraday. It stops you from facing big losses. In stop-loss, you’ve to set a limit. Let’s take an example if you buy a stock and it’s going the opposite then stop-loss will save you from losing all the capital you have.

2- Target:

Like stop-loss target is also important. How? Let me tell you. If we have an idea of where to stop, we’ll have consistent and disciplined money management and can avoid losses. For example, we have taken the trade and it’s going all fine you’re making profits but suddenly the market took a turn and that green thing started changing red to have more money, here you’ll lose all the profits if you don’t have a target.

3- One-two trade in a day:

Trade management is very important, taking more than two trades to recover your losses can make you lose your capital. So avoid taking multiple trades.

4- 70/30 rule:

If your analysis is right still your trade can be 70% winning and 30% losing. Always remember 70/30 rile is applied everywhere.

These are a few things I learned after making huge mistakes. These things can help you grow your account in a disciplined way and it will help you to avoid losses.

More things like money management and risk management are also important. I’ve discussed them in my previous blogs and will mention the link below.

Leave a comment